Bank executives have a relatively stable view of Wisconsin’s economy, despite ongoing uncertainty around tariffs and the national economic picture.

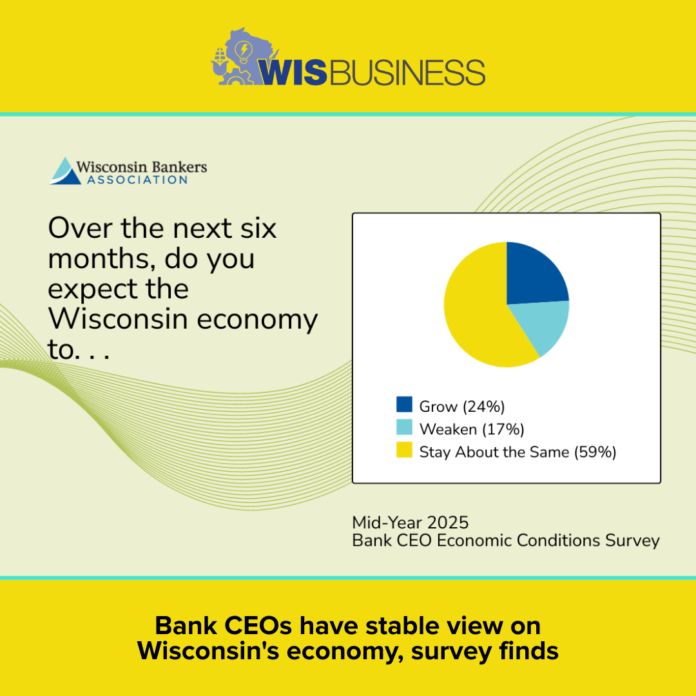

That’s according to the Wisconsin Bankers Association’s Economic Conditions Survey of Wisconsin bank CEOs. It found 59% of respondents expect the state economy to stay the same over the next six months. At the same time, 24% expect it to grow over that period and 17% expect it to weaken.

In the mid-year survey from 2024, 70% had expected the state economy to remain the same for the coming six months, while just 8% had expected it to grow and 23% had expected it to weaken.

At the same time, perspectives on the current state of Wisconsin’s economy have improved slightly since the last mid-year survey. In the latest look, 7% said the health of the state economy is excellent, while 79% said it’s good and 15% said it’s fair. No respondents said it’s poor.

In the same survey from the midpoint of 2024, 5% had said the state economy was excellent, 71% said good and 24% said fair. As with the latest survey, no respondents rated the economy as poor.

Meanwhile, expectations around inflation have worsened somewhat. In the latest survey, 23% of bank CEOs said they expect inflation to rise over the next six months, while 15% expect it to fall and 63% expect it to stay about the same.

In last year’s mid-year survey, 8% had expected inflation to rise over the coming six months, 26% had expected it to fall and 66% had expected it to remain unchanged.

When asked about the possibility of a recession coming in the next six months, 39% of respondents to the latest survey said it’s unlikely or very unlikely. Thirty-nine percent were also neutral on the question, while 23% said it’s likely or very likely.

Those expectations have shifted slightly from WBA’s last mid-year survey. At the time, 43% had said it was unlikely or very unlikely, 32% were neutral and 24% said it was likely or very likely.

The latest survey also posed a new question, asking respondents if their business customers have reported any impact from new tariffs or the possibility of new tariffs. Three percent said these customers are reporting a positive impact, while 24% said they’re seeing a negative impact, 16% said they’re not impacted and 57% said they’re not impacted “as of yet.”

Bank executive respondents pointed to new businesses moving into local markets, few business failures, a strong manufacturing sector, expansion in farming and strong tourism as “economic bright spots,” WBA notes.

But looking ahead to the second half of this year, respondents said their business customers’ top concerns include economic uncertainty due to tariffs, global instability, interest rates, more costly insurance, farmers’ ability to sell crops, high costs for materials and employee housing.

“Survey respondents also reflected it is difficult to forecast given fluctuations in tariff negotiations, that the housing market is on hold for lower interest rates, but that ‘business as usual’ is reassuring and stabilizing during times of uncertainty and change,” the group said in a release.

The online survey was conducted June 3-30 and had 72 respondents.

See the full results here.