The NFIB Research Center’s latest survey on the current impact of the COVID-19 outbreak on small business shows continued deterioration of the small business sector. The severity of the outbreak and regulatory measures that cities and states are taking to control it are having a devastating impact on small businesses.

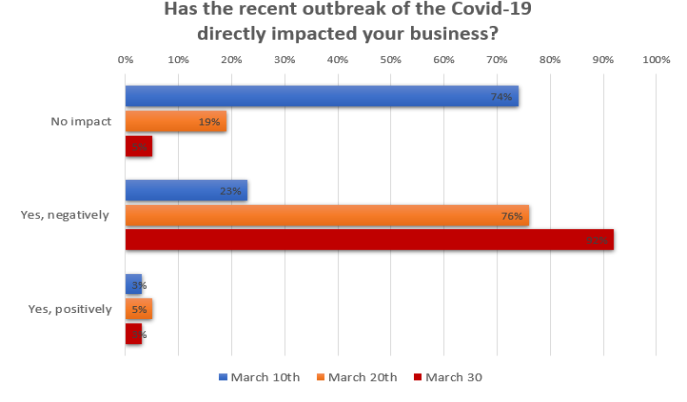

Currently, 92% of small employers are negatively impacted by the outbreak of the novel coronavirus, a continued escalation from 76% of small employers reporting negative impacts 10 days earlier. About 3% are positively impacted. These firms are likely experiencing stronger sales due to a sharp rise in demand for certain products, goods, and services. This will likely ease in the coming weeks as consumers feel more secure about their personal supply levels.

“As the COVID-19 related funding flows out of Washington DC to the states, it is vitally important Wisconsin’s small business owners act promptly to secure financial assistance,” said Bill G. Smith, NFIB State Director in Wisconsin. “NFIB is encouraging members to apply as soon as possible since there is a funding cap on the Paycheck Protection Program, which small business owners can start applying for tomorrow.”

In Sturgeon Bay, Cain Goettelman of FLS Banners wants to do the right thing. His business can produce isolation gowns, medical popup tents, hospital directional flags, and he has the supply network to order in millions of high quality and regular masks. His problem? City and state governments are having a hard time finding out how to order the supplies from his small business. Goettelman could get governments and hospitals 500,000 masks in a week plus thousands of isolation gowns. He says he’s made hundreds of calls but still can’t connect with the right people. He knows hospitals and governments are in need and he wants to help.

On Monday, Goettelman decided to pivot and start producing much needed supplies without an order from a hospital or government. Frustrated by an image he saw on social media of a doctor wearing a garbage bag, his idea to produce level one hospital gowns is now in action. Working with one of his suppliers, Goettelman ordered a plastic like material that he can cut in one piece, making it efficient to make: up to 1,200 per day with two shifts of 20 workers. Plus, Goettelman says he will sell them at one sixth of the cost that the city of New York is currently paying for level one gowns.

One of Goettelman’s employees models the gown he starting producing at his factories this week.

“I’m turning over every stone I can to help during this health crisis. I know hospitals and governments are desperate to get supplies I just want to help. So do my employees. They are in 100% even though we are making a product we don’t have a buyer for. The market is broken. I am producing thousands of gowns per day and even though there is a mass shortage out there, I don’t have anyone to buy them. I don’t want to make a bunch of money. We just want to feel like we’re doing good during this time of unprecedented fear surrounding this health crisis.”

Goettelman has also started producing “fashion masks” – named to take away the stigma surrounding surgical masks. Recently the city of LA started recommending its residents wear them and Goettelman thinks other cities will follow suit. He’s designed about 50 different masks.

One of the “fashion masks” Cain started producing this week.

“I want to take this to a new level. You shouldn’t feel like you’re sick or have a scarlet letter on your chest if you decide to wear a mask. I want people to feel comfortable if they want to wear one.”

Almost all small employers are now impacted by economic disruptions related to COVID-19. Only 5% of small businesses are not currently affected by the outbreak. Of these businesses, 44% of them anticipate that changing if the outbreak spreads to, or spreads more broadly in, their immediate area over the next 3 months.

Among negatively impacted small employers, 80% report slower sales, 31% are experiencing supply chain disruptions, and 23% report concerns over sick employees.

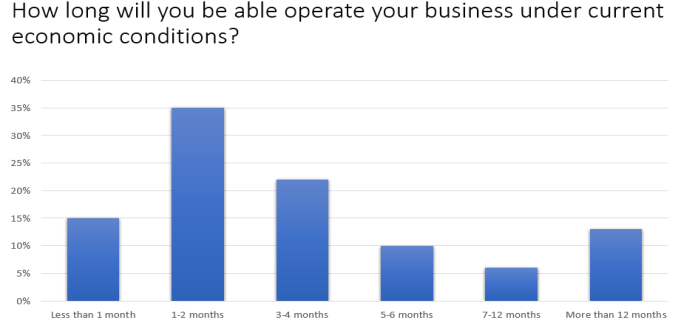

How long can small businesses continue to operate under current conditions? About half of small employers say they can survive for no more than two months, and about one-third believe they can remain operational for 3-6 months. Not surprisingly, many small business owners are anxious to access financial support through the new small business loan program to help alleviate some of the financial pressures building up. About 13% of small employers are not as severely impacts and expect to remain open indefinitely.

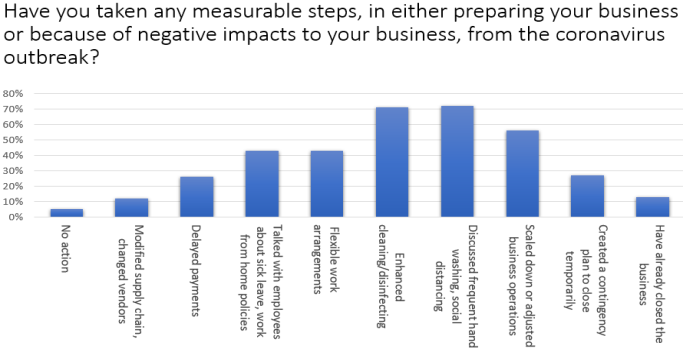

Almost all small business owners are taking some sort of action in response to the outbreak by adjusting to changing economic conditions or protecting themselves from potential disruption. Just 5% of owners have not taken any action in response to the outbreak, a marked departure from more than half (52%) not taking action three weeks ago. Actions taken by most small employers are those related to recommended CDC steps to protect and prevent the spread of COVID-19 in the workplace including talking to employees about hand washing and social distancing, and disinfecting and cleaning offices and workplaces more frequently. Another 56% have scaled down or adjusted business operations, and 26% have delayed payments to creditors.

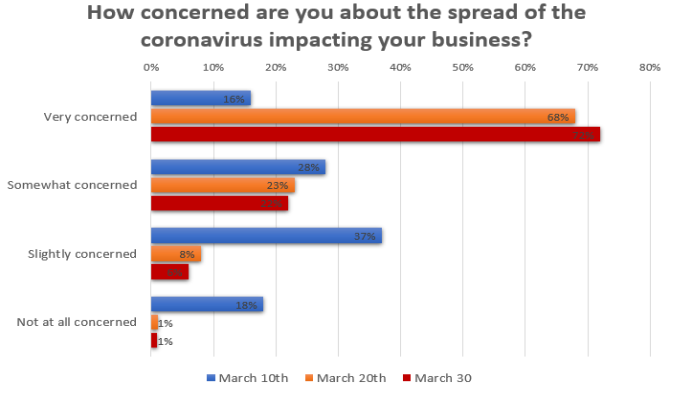

The level of concern among small business owners about the coronavirus impacting their business has elevated significantly over the past three weeks. About 72% of small business owners are “very” concerned about its potential impact on their business now compared to 16% on March 10th. Another 22% are somewhat concerned, and 6% are slightly concerned. Just 1% are not at all concerned.

Due to escalating financial stress on the small business sector, more small businesses are talking with their bank about financing needs than was the case 10 days ago. About 29% of small employers have talked with someone at their bank or with the Small Business Administration about finance options, and 23% are planning to do so soon. Another 38% of small employers have not, and do not, intend to do so.

The CARES Act includes new small business loans through the Paycheck Protection Program (PPP). Almost two-thirds of small employers plan to apply for the loan. The PPP is another targeted loan assistance program to help small businesses weather the rapidly changing economic crisis.

The vast majority of small businesses are now impacted by the COVID-19 outbreak, and owners are taking the threat to their business seriously. Many owners have already sought out financial help and more are planning to do so in the near future. The outbreak has left few, if any, owners unscathed. The economic impact is immense, and now, the questions are how long will it last and how quickly can the small business sector recover once on the other side.

Methodology

This survey was conducted with a random sample of NFIB’s membership database of about 300,000 small business owners. The survey was conducted by email on March 30, 2020. NFIB collected 1,172 usable responses, all small employers with 1-465 employees.